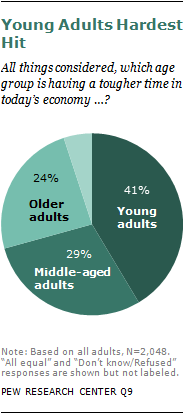

Recent economic times have been particularly hard on young adults. The economic data illustrate this, especially with regard to the labor market. And the public recognizes it. When asked which age group is having a harder time in today’s economy, a plurality of Americans (41%) say young adults are struggling the most. Roughly three-in-ten (29%) say middle-aged adults are having the toughest time, and 24% point to older Americans.

Opinion about this is fairly consistent across major demographic groups. Men and women agree that young people are suffering the most from today’s tough economic times. Whites and blacks are also largely in agreement—with pluralities of both groups saying young people are having the hardest time.

More affluent adults and those with higher levels of education are among the most likely to say that young people are struggling in today’s economy. Nearly half (48%) of college graduates say young adults are having the hardest time these days. This compares with 37% of those whose educational attainment is a high school diploma or less. Similarly, adults with annual household incomes of $75,000 or higher are much more likely than those making less than that to say young people have been hit harder than their older counterparts (52% vs. 37%, respectively).

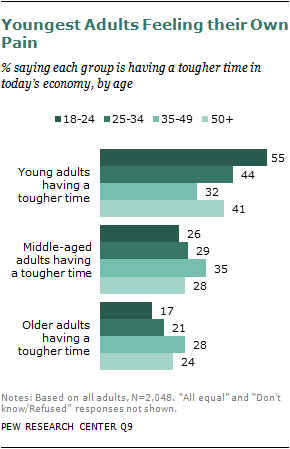

Young adults themselves have a very clear sense that they have suffered more than other age groups as a result of the nation’s recent economic struggles. Fully 55% of those ages 18 to 24 say young adults are having the toughest time in today’s economy. Roughly one-in-four (26%) say middle-aged adults have had a tougher time, and only 17% say older adults have struggled most.

The views of those ages 25 to 34 are somewhat different than their younger counterparts: 44% say young adults are having the hardest time in today’s economy. Middle-aged Americans are among the least likely to say young people have been hardest hit by economic hard times. Still, pluralities in most age groups acknowledge that young adults have been hit disproportionately hard.

The Day-to-Day Realities of Economic Hard Times

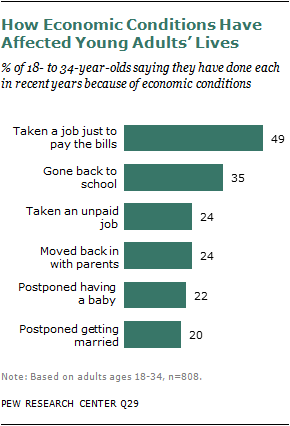

Many young adults have felt the impact of the recession and sluggish recovery in tangible ways. Fully half (49%) of those ages 18 to 34 say that because of economic conditions over the past few years, they have taken a job they didn’t really want just to pay the bills. More than a third (35%) say they have gone back to school because of the bad economy. And one-in-four (24%) say they have taken an unpaid job to gain work experience.

For some, tough economic times have had an impact on their personal life as well. Roughly a quarter of adults ages 18 to 34 (24%) say that, due to economic conditions, they have moved back in with their parents in recent years after living on their own. Among those ages 25 to 29, the share moving back home rises to 34%. Most adults under age 25 are enrolled in school at least part time (46% are full-time students). By age 25, the majority are out of school, but jobs and housing can be hard to come by, and many “boomerang” back home.

More than one-in-five young adults ages 18 to 34 (22%) say they have postponed having a baby because of the bad economy. Roughly the same proportion (20%) say they have postponed getting married.

There are some significant differences in the impact of the recession among young adults by race, particularly in the areas of education and employment. The economic data show that young blacks have an even higher unemployment rate than do young whites or young Hispanics. And even for young blacks who are working, their employment situation may not be highly satisfying. More than six-in-ten (62%) blacks ages 18 to 34 say in recent years they have taken a job they didn’t really want just to pay the bills. This compares with 47% of whites in the same age group and 54% of Hispanics.

Young blacks are also more likely to report that they have gone back to school because of hard economic times. Half of the young blacks surveyed say they have returned to school in recent years, compared with 32% of young whites and 36% of Hispanics.

Young whites and Hispanics are more than twice as likely as young blacks to say they have moved back in with their parents after living on their own because of economic conditions. Among those ages 18 to 34, 26% of whites and 29% of Hispanics say they have moved back home, compared with 13% of blacks.

Young Hispanics are more likely than young whites to say they have postponed getting married because of the economy.

While race and ethnicity seem to have divided young adults in terms of the impact of the recession, there are very few differences along gender lines. Men suffered much greater job losses than women during the recession. However, the current survey finds that the impact of recent economic conditions has been fairly equal on young men and young women. Among those ages 18 to 34, men and women are equally likely to report that, in recent years due to economic conditions, they have taken a job they really didn’t want just to pay the bills. Similar shares say they have gone back to school (35% of young men and 36% of women). And they are equally likely to say they have moved back in with their parents and postponed marriage and childbirth.

There is one significant difference between young men and young women. While 30% of men ages 18 to 34 say they have taken an unpaid job to gain experience in recent years, only 18% of young women say they have done the same.

When it comes to marriage and family, young adults without a college education are among the most likely to say economic conditions have affected their plans. Among those ages 18 to 34 who are not college graduates and are not currently enrolled in school, nearly three-in-ten (28%) say they have put off getting married and an equal proportion say they have put off having a baby because of the economy. Among young adults who graduated from college or are currently enrolled in school, only about half as many say the same.

The Challenges Facing Today’s Young Adults

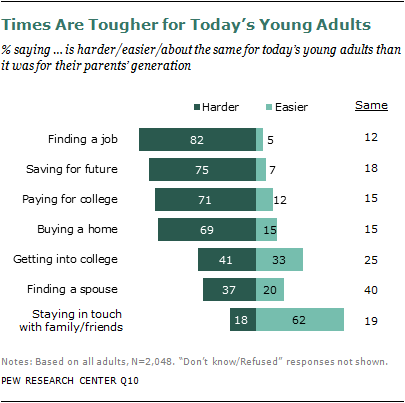

There seems to be a near consensus among the public that today’s young adults face greater challenges than their parents did in reaching some of the most basic economic benchmarks. Strong majorities of the public say it’s harder for young adults today to find a job, save for the future, pay for college or buy a home than it was for their parents’ generation.

Among adults of all ages, 82% say it’s harder for today’s young adults to find a job than it was for their parents’ generation. Only 5% say it’s easier now to find a job, and 12% say finding a job is about the same as it was a generation ago.

Three-out-of-four adults say it’s harder for young people to save for the future today than it was for their parents. And seven-in-ten (69%) say it’s harder for today’s young adults to buy a home.

Paying for college is also viewed as a greater challenge today than it was in the past. Fully 71% of all adults say it’s harder for today’s young people to pay for college than it was for their parents’ generation. When it comes to getting into college, views are more mixed. Four-in-ten adults (41%) say it’s harder for young people to get into college today than it was a generation ago. However, one-third say it’s easier today, and 25% say it’s about the same as it was for their parents’ generation.

The public sees fewer challenges for today’s adults in two areas outside of the economic realm. Only 37% of all adults say it’s harder for today’s young people to find a spouse or partner compared with their parents’ generation. One-in-five say it’s easier for today’s young adults, and 40% say it’s the same as it was for their parents’ generation. When it comes to keeping in touch with friends and family, most adults (62%) say it’s easier for today’s young people to stay connected than it was for their parents. Only 18% say it’s harder to keep in touch these days, and 19% say it’s about the same.

Young and older adults tend to agree that, from an economic perspective, things are harder for those just starting out today than they were a generation ago. Adults ages 35 and older are even more likely than those ages 18 to 34 to say it’s harder for young people to find a job today than it was for their parents’ generation (84% vs. 79%). Middle-aged and older adults are also more likely than their younger counterparts to say it’s harder for today’s young people to get into and pay for college. The cost of college has roughly tripled since 1980, and this burden often falls to the parents. This may help explain why parents of children ages 18 and older are even more likely than young adults themselves to say that paying for college is harder for young adults today than it was for their own generation.18

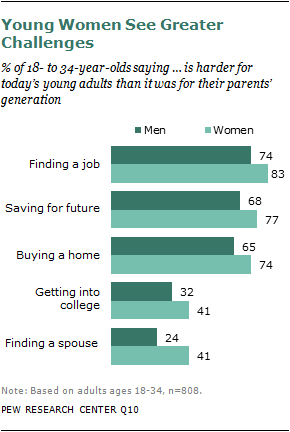

While young men and young women generally agree that they face greater economic challenges than their parents did, women provide an even more negative assessment than do men. Among those ages 18 to 34, women are more likely than men to say finding a job is harder for today’s young adults than it was for their parents’ generation (83% vs. 74%). They are also more likely to say it’s harder for today’s young adults to save for the future (77% vs. 68%). Similarly, more young women than men say it’s harder to buy a home and harder to get into college than it was a generation ago.

The biggest gap between men and women involves personal life rather than finances. While 41% of women ages 18 to 34 say finding a spouse or partner is harder for today’s young adults than it was for their parents’ generation, only 24% of young men agree.

Coming of Age in Challenging Times

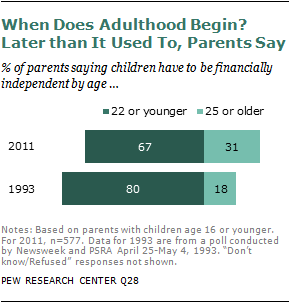

One possible byproduct of the economic challenges today’s young adults face may be shifting societal norms about when adulthood begins. When asked in a 1993 survey what age children should be financially independent from their parents, 80% of parents said children have to be self-reliant by age 22. In the current survey, only 67% of parents say children have to be financially independent by age 22—a drop of 13 percentage points.

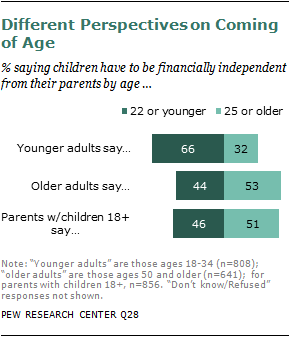

Looking at the responses among all adults, regardless of parental status, a clear age pattern emerges. A solid majority of young adults (66%) believe children should be financially independent by age 22, including 23% who say they should be supporting themselves by age 18. By contrast, among those ages 50 and older, only 44% say children have to be financially independent by age 22, while a narrow majority (53%) says they needn’t be independent until age 25 or older. On this issue, the views of adults ages 35 to 49 are much closer to those of their younger counterparts than to those ages 50 and older.

Being a parent of a young adult is also strongly correlated with views about when adulthood begins. Among those with children ages 18 or older, less than half (46%) say children need to be financially independent from their parents by age 22, while 51% say they don’t need to be independent until age 25 or older.19

Young Adults and Personal Finances

In spite of the economic challenges young people face, they are happy with their lives overall. One-third of those ages 18 to 34 say they are very happy with the way things are going in their life and an additional 55% say they are pretty happy. Young adults register somewhat higher levels of happiness than do their older counterparts, but they still find certain aspects of adult life difficult.

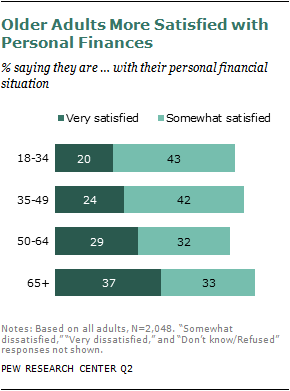

When it comes to their personal financial situation, young adults are somewhat less satisfied than middle-aged and older adults. Overall, 63% of those ages 18 to 34 say they are satisfied with their personal finances; however, only 20% are very satisfied. A similar share (24%) of those ages 35 to 49 are very satisfied with their personal finances, and the share among those ages 50 to 64 is slightly higher (29%). Adults ages 65 and older are more satisfied than any other age group with their financial circumstances: 37% are very satisfied, and 33% are somewhat satisfied. The gap between the youngest and the oldest adults has grown wider in recent years. In February 2009, 21% of those ages 18 to 34 said they were very satisfied with their financial situation, compared with 31% of those ages 65 and older.20

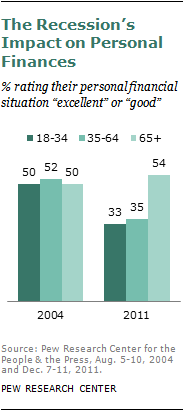

In a similarly worded question asked in 2004, before the recession began, there was no gap between young adults and older adults in their assessments of their personal finances. Equal shares (50%) of adults ages 18 to 34 and those ages 65 and older rated their personal financial situation as excellent or good. A separate Pew Research poll in December 2011 showed that a sizable gap (21% points) had emerged between older adults and young adults—only a third of those ages 18 to 34 said they were in excellent or good financial shape, compared with more than half (54%) of those ages 65 and older. In the 2011 survey, older adults stood out in this regard, as middle-aged adults were closer to young adults in their assessments of their personal financial situation.

Not surprisingly, educational attainment and job satisfaction are linked to assessments of personal finances for all adults. College graduates are much more likely than those who have not graduated from college to say they are very satisfied with their personal financial situation. Among adults ages 18 to 34, 29% of those who have graduated from college say they are very satisfied with their financial situation. This compares with 19% of those who are currently enrolled in school and 17% who did not graduate from college and are not currently enrolled.

Job satisfaction is also highly correlated with satisfaction with personal finances. Among young adults who are employed, 42% of those who say they are completely satisfied with their current job are also very satisfied with their personal financial situation. Among those who say they are somewhat satisfied with their job, only 15% are very satisfied with their financial situation.

Beyond Finances: Family Life, Housing and Education

Young adulthood is often marked by several major life transitions. Some young adults are still finishing their education, some are living on their own for the first time and some are starting their own families. Although the lives of many are not entirely settled, most young adults say they are highly satisfied with their family life. Nearly half are very satisfied with their present housing situation and with their education.

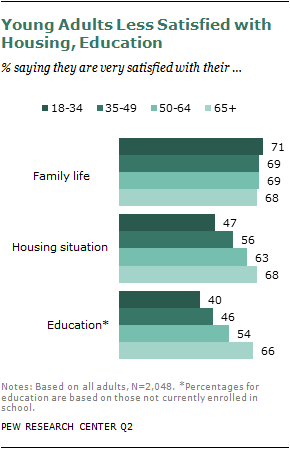

Adults of all ages are highly satisfied with their family life. Seven-in-ten adults ages 18 to 34 (71%) say they are very satisfied with this aspect of their life. Among those ages 35 to 49, 50 to 64 and 65 and older, nearly as many say the same.

Age is much more strongly related to satisfaction with living arrangements. This is not surprising, given that roughly a quarter of those ages 18 to 34 live with their parents, more than four-in-ten rent, and less than one-in-four own their own homes. Among adults under age 35, only 47% say they are very satisfied with their present housing situation. This compares with 62% among those ages 35 and older.

The gap in views about housing was not nearly as wide in 1996. Among those ages 18 to 34, 50% said they were very satisfied with their housing situation. Young adults were not markedly different from middle-aged adults in their regard—53% of those ages 35 to 49 said they were very satisfied with their housing situation. Among those ages 50 and older, satisfaction was significantly higher (65% for those ages 50 to 64 and 67% for those ages 65 and older).21

Young adults are less satisfied overall with their education when compared to their older counterparts. Granted, many of them have not yet completed their education. However, even among those ages 18 to 34 who are not currently enrolled in school, only four-in-ten say they are very satisfied with their education. This compares with roughly half (52%) of those ages 35 to 64 and 66% of those ages 65 and older.

College graduates of all ages are much more satisfied with their education than are those who have not completed college. Fully 71% of those under age 35 with a college degree say they are very satisfied with their education. Roughly half (52%) of young adults who are currently enrolled in school say they are very satisfied, and only 29% of those who are not enrolled and do not have a college degree say the same.