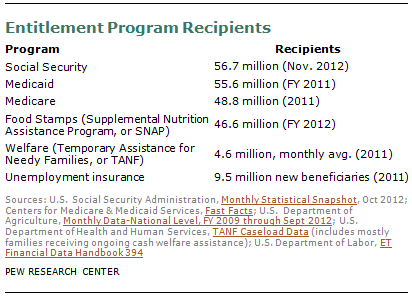

This report has analyzed six large and well-known federal government entitlement programs. While our survey asks the public to self-report its use of these programs over the span of their lifetime or the lifetimes of other household members, data from the programs themselves provide a more current snapshot of recipients. Using the most recent available data, this appendix summarizes the aims of the programs, eligibility requirements, currently enrollment and total costs.

About the Program: Social Security6

What is it?

Social Security refers to the Old-Age, Survivors and Disability Insurance (OASDI) program that provides monthly benefits to a worker or the worker’s family to alleviate loss of income due to retirement, death or disability of the insured worker. There is no means test to qualify, but eligibility and benefits amounts are determined by the worker’s contributions to Social Security. Current workers and employers pay into the program through a payroll tax or self-employment tax.

The Social Security Administration also administers the means-tested Supplementary Security Income (SSI) program, which was created in 1974 to replace various state-run programs. SSI provides income support to elderly, blind or disabled adults and to blind or disabled children with limited income and resources (in most cases, resources must be less than $2,000 for an individual or $3,000 for a couple). For some, it is possible to receive SSI in addition to Social Security benefits. Furthermore, because this program is funded by general tax revenue and not Social Security taxes, an individual need not have paid into Social Security taxes to be eligible for benefits.

Who is eligible?

- Retired workers (62 and older) and their families.

- Survivors of deceased workers.

- Disabled workers and their families.

How many Americans? What are the costs?

In November 2012, 56.7 million Americans, 39.6 million of whom were retired workers or their families, received Social Security. The total expenditure in FY 2011 was $724.9 billion.

An additional 5.5 million people received only Supplemental Security Income (SSI). The total expenditure in FY 2011 for all people receiving SSI (including those who were receiving both Social Security and SSI) was $49.6 billion.

About the Program: Medicaid7

What is it?

Medicaid is a state-run, means-tested health insurance program for families, the elderly and people with disabilities who are lower income. It is jointly funded by the states and the federal government.

Who is eligible?

Eligibility for certain groups (individuals, families, pregnant women and seniors with lower incomes) varies by state, but in all states:

- People with disabilities are eligible, sometimes dependent on their income and resources.

- All states provide coverage for children through the Children’s Health Insurance Program (CHIP) for individuals with family-of-four incomes of about $45,000 or less.

- Starting in 2014, most people younger than 65 with an income of less than $15,000 for a single individual (and slightly higher income cutoffs for couples and families with children) will be eligible.

How many Americans? How much money?

As of June 2011, 52.6 million Americans were receiving Medicaid. The total federal expenditure in FY 2010 was $272.8 billion; taken together, the federal and state expenditure was $389.1 billion.

About the Program: Medicare8

What is it?

Medicare is a federal health insurance program for people ages 65 and older and certain younger people who receive long-term disability benefits or who have permanent kidney failure or amyotrophic lateral sclerosis (Lou Gehrig’s disease). Medicare was established under President Johnson in 1965 under Title XVIII of the Social Security Act.

Medicare does not entirely cover the costs of all medical expenses or most long-term care. Medicare Part A (hospital insurance) is available without a premium for those eligible. Part B (medical insurance) is available for a monthly premium of about $100.

Current workers pay into the program through a payroll tax and monthly premiums are deducted from Social Security checks.

Who is eligible?

- Adults ages 65 and older who are citizens or permanent residents are eligible if they receive or are eligible for Social Security benefits or they or their spouse worked long enough in Medicare-covered employment.

- Adults younger than 65 who received Social Security or Railroad Retirement Board disability benefits for at least 24 months.

- Adults younger than 65 with permanent kidney failure or amyotrophic lateral sclerosis.

How many Americans? How much money?

In 2011, 48.8 million Americans, 40.5 million of whom were receiving benefits because of their age, received Medicare benefits. The total expenditure in FY 2011 was $479.9 billion.

About the Program: Supplemental Nutrition Assistance Program (SNAP)9

What is it?

The Supplemental Nutrition Assistance Program (SNAP), commonly known as “food stamps,” is a federal means-tested nutrition program that provides financial assistance to low-income people to purchase food.

Although SNAP is a federal program overseen at the federal level by the U.S. Department of Agriculture (USDA), it is run by state and local agencies.

Who is eligible?

Eligibility is based on family size, citizenship status, household income, assets and certain expenses. Eligibility usually requires income below the state-determined cutoff and $2,000 or less in “countable resources” ($3,000 or less if an elderly or disabled person resides in the household).

Someone can receive SNAP even if that person is not receiving cash welfare or if the person is currently receiving regular income.

In most cases, able-bodied adults ages 18 to 60 who are receiving SNAP must attempt to get work or participate in work activities.

How many Americans? How much money?

In FY 2012, 46.6 million people (22.3 million households) received SNAP. The total federal expenditure in FY 2012 was $74.6 billion.

About the Program: Temporary Assistance for Needy Families (TANF)10

What is it?

Temporary Assistance for Needy Families (TANF), commonly referred to as “welfare” or “public assistance,” is a block grant welfare program that provides cash assistance and support services to assist needy families with children younger than 18. The aim of TANF is to turn welfare into a temporary assistance program by moving recipients into the workforce.

The TANF program was created by welfare reform legislation in 1996, and replaced a program known as Aid to Families with Dependent Children (AFDC), which had provided assistance since 1935.

The Department of Health and Human Services provides a block grant to states and territories, which administer the program. To receive the federal grant, states must also spend state funds on programs benefiting needy families.

In most cases, TANF includes a 60-month maximum lifetime benefit time frame (consecutive or not), though through state funds and other means some beneficiaries can receive benefits for a longer period of time. With a few exceptions, able-bodied adult recipients are required to participate in work or work-training activities in order to continue to receive the benefits.

Who is eligible?

TANF eligibility varies somewhat from state to state, but in general funds must be used to serve families with children under 18 whose family income and assets are below the state-determined guidelines and who meet certain other non-financial criteria (e.g., citizenship status, work requirements).

How many Americans? How much money?

As federal TANF rules only require reporting the number of families receiving ongoing (mostly cash welfare) assistance, data likely undercount the number of families receiving any TANF-funded benefit or service, as only about half of TANF funds are used on traditional “welfare” assistance. In FY 2011, TANF had an average of 4.6 million monthly recipients of “assistance” welfare, which consisted of an average of 1.9 million families a month.

The U.S. Department of Health and Human Services breaks TANF expenditures into two categories. In FY 2011, the federal government spent $6.4 billion and the states spent $4.7 billion on basic assistance and related programs; during that time, the federal government spent $8.7 billion and the states spent $10.8 billion on non-assistance programs, such as out-of-wedlock pregnancy prevention programs and payments for support services (such as transportation or child care) to employed families.

About the Program: Unemployment Insurance11

What is it?

The Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are regularly employed and became unemployed “through no fault of their own.” Each state administers its own unemployment insurance program, following guidelines of federal law, but the states have major responsibility for determining key aspects of the program (e.g., the amount and duration of benefits, employee contribution rates). In most states, the program is funded solely on a tax imposed on employers.

Who is eligible?

Benefits are available to unemployed workers who have demonstrated that they meet the state’s standards for amount of recent work or earnings in insured employment. Unemployed workers must be “involuntary unemployed, able to work, available for work and actively seeking work.” They may not have been discharged for misconduct or have voluntarily quit their jobs without good cause. They must also meet other eligibility requirements of their states. In most states, benefits are based on a percentage of an individual’s recent earnings, and they are capped at 26 weeks. There are slightly different programs for federal civilian employees and ex-service members, and in the case of high unemployment and disaster areas.

How many Americans? How much money?

In 2011, there were 9.5 million first payments nationwide and a total of 165.5 weeks compensated for all employment. The combined state and federal spending in FY 2011 was $117.2 billion.