By many measures, the U.S. economy is doing well. Unemployment is near a 50-year low, consumer spending is strong and the stock market is delivering solid returns for investors. Despite these positive indicators, public assessments of the economy are mixed, and they differ significantly by income, according to a new Pew Research Center survey.

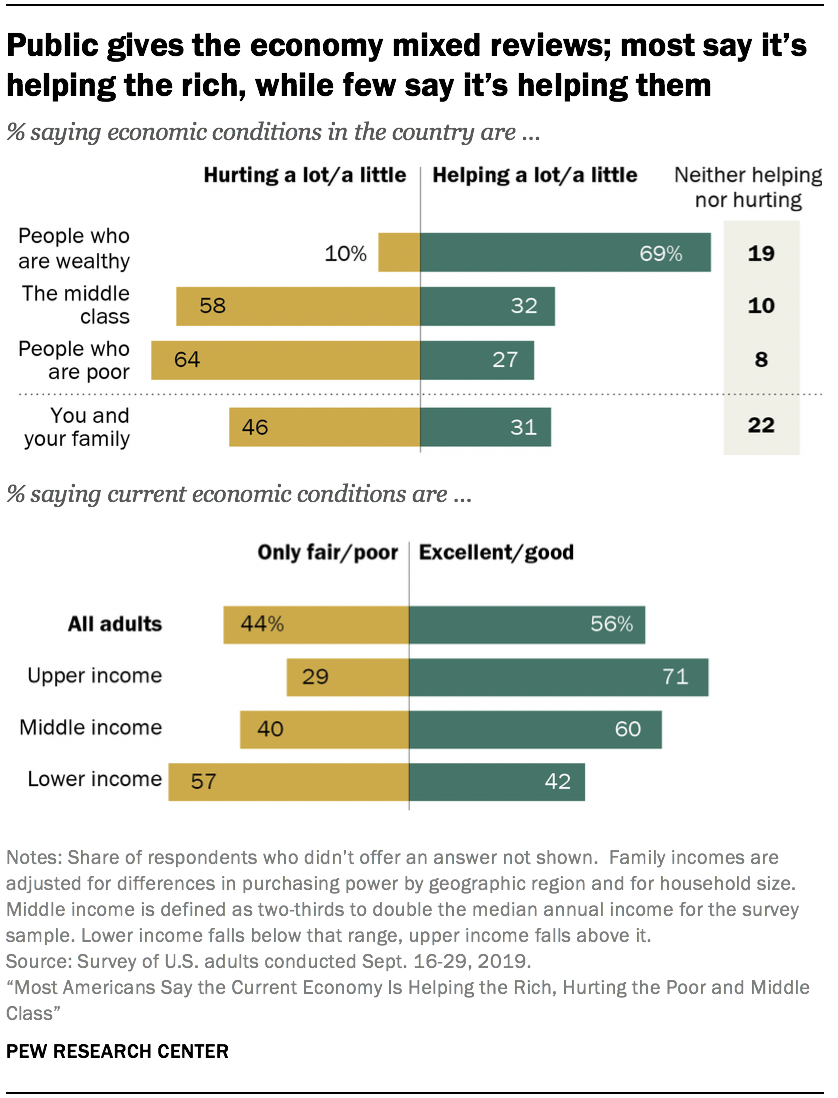

Majorities of upper-income and middle-income Americans say current economic conditions are excellent or good. But only about four-in-ten lower-income adults share that view, while a majority say the economy is only fair or poor.

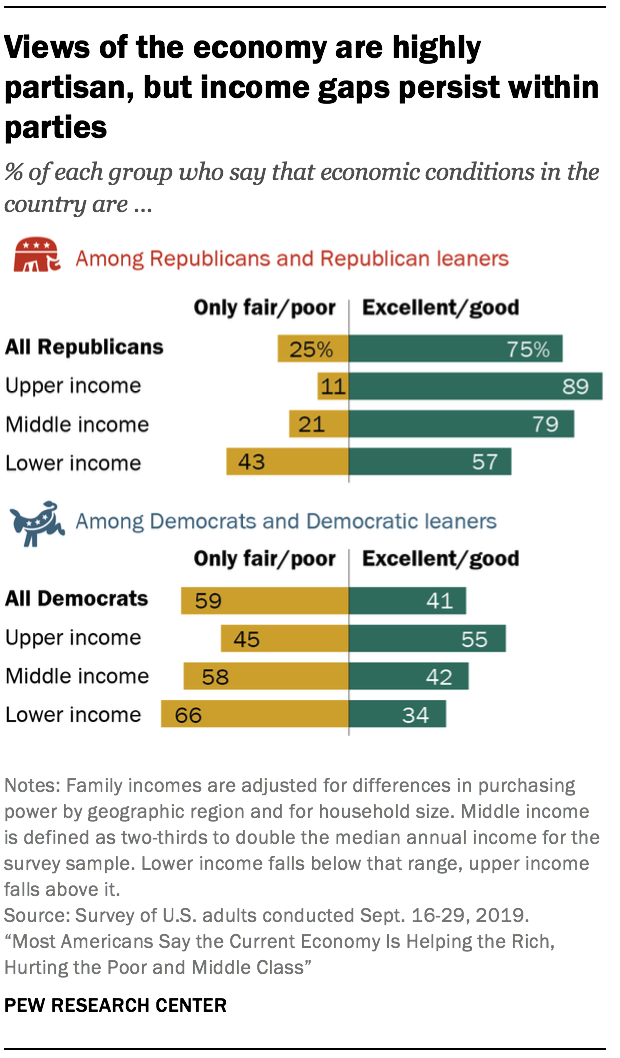

Views of the economy are strongly linked to partisanship, with Republicans and independents who lean toward the Republican Party much more likely than their Democratic and Democratic-leaning counterparts to have a positive view of the current economy. While attitudes toward the economy have long been partisan, they are particularly so today – and virtually all the increase in positive views of the economy since Donald Trump became U.S. president has been among Republicans. Still, income gaps persist within these party groups. In fact, lower-income Republicans are roughly four times as likely as those in the upper-income tier to give the economy an only fair or poor rating.

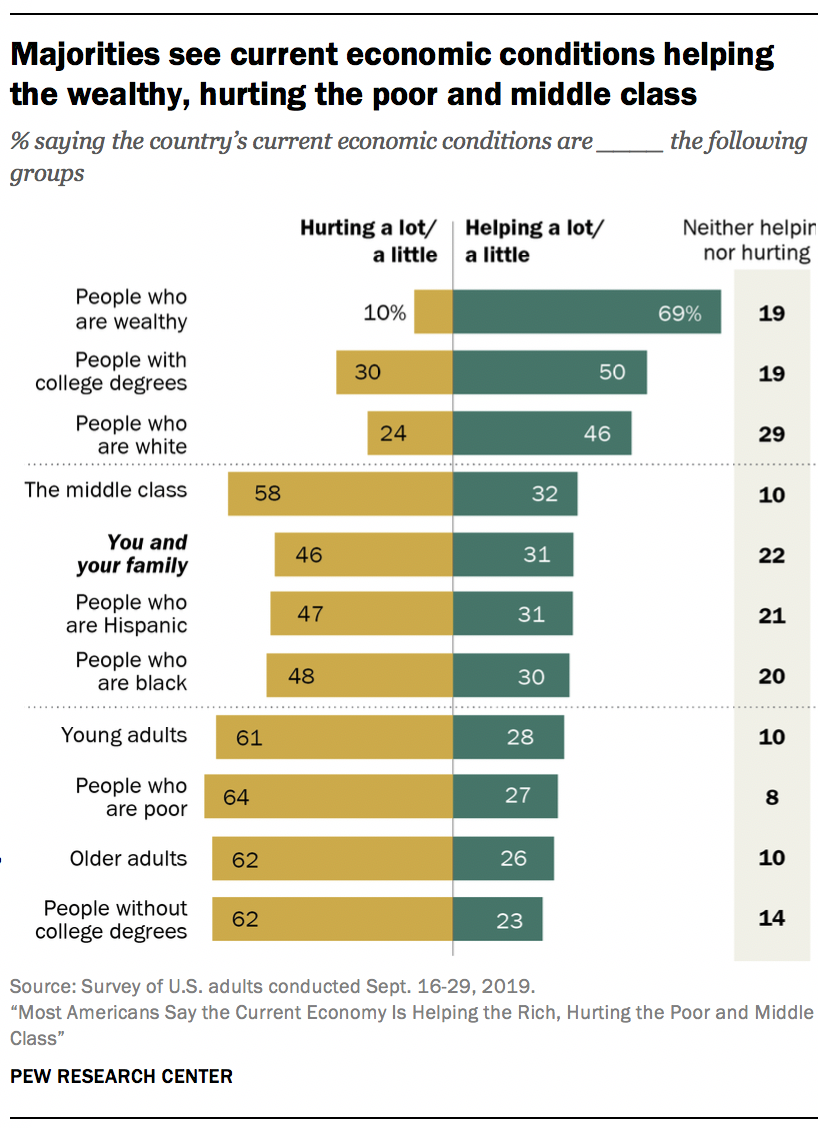

To the extent that current economic conditions are helping particular groups, the public sees the benefits flowing mainly to the most well-off. Roughly seven-in-ten adults (69%) say today’s economy is helping people who are wealthy (only 10% say the wealthy are being hurt). At the same time, majorities of Americans say poor people, those without a college degree, older adults, younger adults and the middle class are being hurt rather than helped by current economic conditions.

When asked how economic conditions are affecting them and their families, nearly half of adults (46%) say they are being hurt, 31% say they’re being helped and 22% say they don’t see much of an impact. Overall, Democrats are more likely than Republicans to say economic conditions are hurting their own families, but views differ significantly by income within parties.

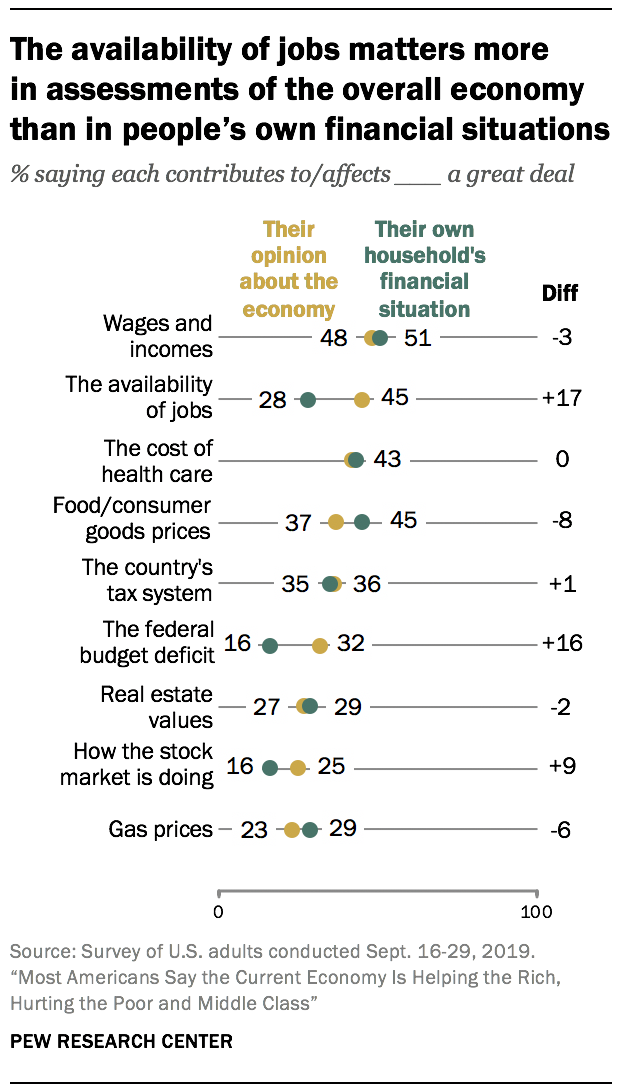

A variety of factors go into Americans’ assessments of current economic conditions, the most prominent being perceptions about wages and income, the availability of jobs and the cost of health care. Two of these three factors are also seen as having a significant impact on people’s own financial situations: 51% say wages have a great deal of impact on their household finances, and 43% say the same about health care costs. The overall job situation is seen as less personally relevant. Instead, 45% say consumer prices have a large impact on their own financial health.

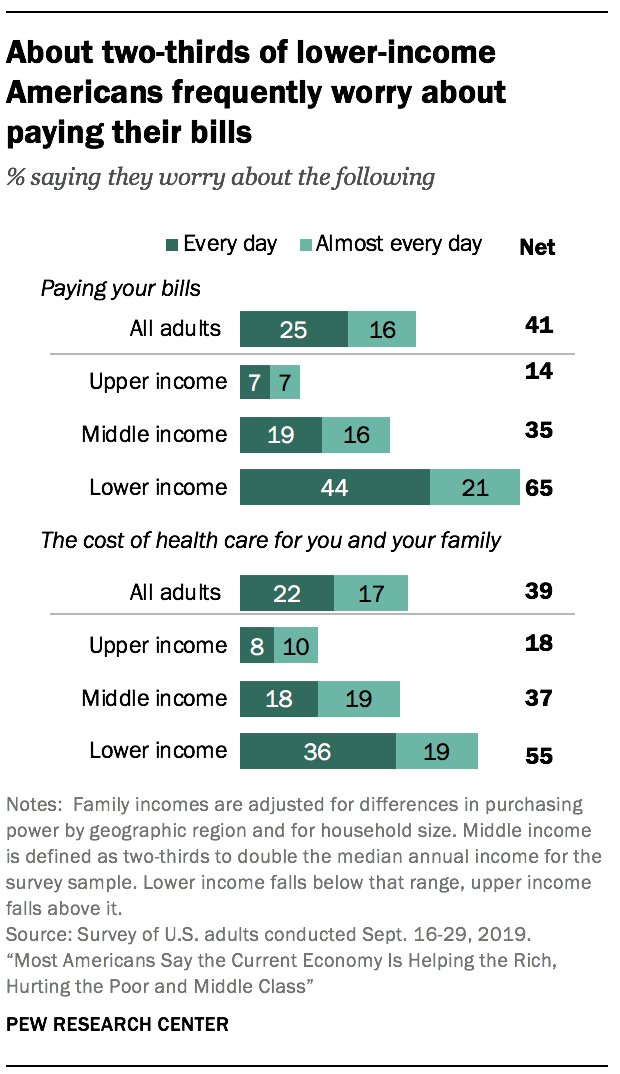

A look inside the financial lives of Americans reveals an enormous gulf in the day-to-day challenges and worries that lower-income and upper-income adults experience. Two-thirds of lower-income adults (65%) say they worry almost daily about paying their bills, compared with about one-third of middle-income Americans (35%) and a small share of upper-income Americans (14%). The cost of health care is also a worry that weighs on the minds of many Americans, particularly those in the lower-income tier. More than half of lower-income adults (55%) say they frequently worry about the cost of health care for themselves and their families; fewer middle-income (37%) and upper-income Americans (18%) share this worry.

The nationally representative survey of 6,878 adults was conducted online from Sept. 16-29, 2019, using Pew Research Center’s American Trends Panel.

Defining income tiers

Views of the economy differ depending on income and political leanings

A majority of Americans (56%) say they think current economic conditions in the country are excellent or good, including relatively few (10%) characterizing conditions as excellent and 46% saying they are good. Roughly four-in-ten Americans (44%) say current economic conditions are only fair (35%) or poor (8%).

While most Republicans and independents who lean to the Republican Party (75%) say economic conditions in the country today are excellent or good, only 41% of Democrats and Democratic leaners share that view.

But within parties, views differ substantially by income. While roughly nine-in-ten upper-income Republicans (89%) feel positively about current economic conditions, lower-income Republicans are far less likely to share that opinion. Some 57% of lower-income Republicans say current economic conditions are excellent or good, roughly similar to the share of upper-income Democrats who say this (55%). Only about one-third of lower-income Democrats (34%) rate current economic conditions positively.

Looking to the future, about half of Americans (48%) say they expect economic conditions will be about the same in a year, roughly one-third (32%) say the economy will be worse and just 20% say they think the economy will be better. The share saying economic conditions will get better is largely consistent across income groups, but upper-income adults are somewhat more likely to say they expect things will get worse.

Current views of the economy are strongly linked to predictions for the future: Those who say economic conditions are excellent or good are about three times as likely as those who have a more negative view to say things will be even better a year from now (29% vs. 9%).

Wages, job availability and health care costs matter most in Americans’ assessment of the overall economy

Americans rely on a variety of indicators to shape their views of the economy. Overall, jobs and wages are among the most important factors in their assessments of current economic conditions. About half of adults (48%) say wages and incomes contribute a great deal to their opinion about how the economy is doing; 45% say the availability of jobs has an equally important impact on their views. The cost of health care is also an important indicator for many Americans – 43% say this contributes a great deal to their assessments of the economy. About a third or more of adults say prices for consumer goods and food (37%), the country’s tax system (36%) and the federal budget deficit (32%) contribute a great deal to their views of the economy. Somewhat less important are real estate prices (27%), stock market performance (25%) and gas prices in their area (23%).

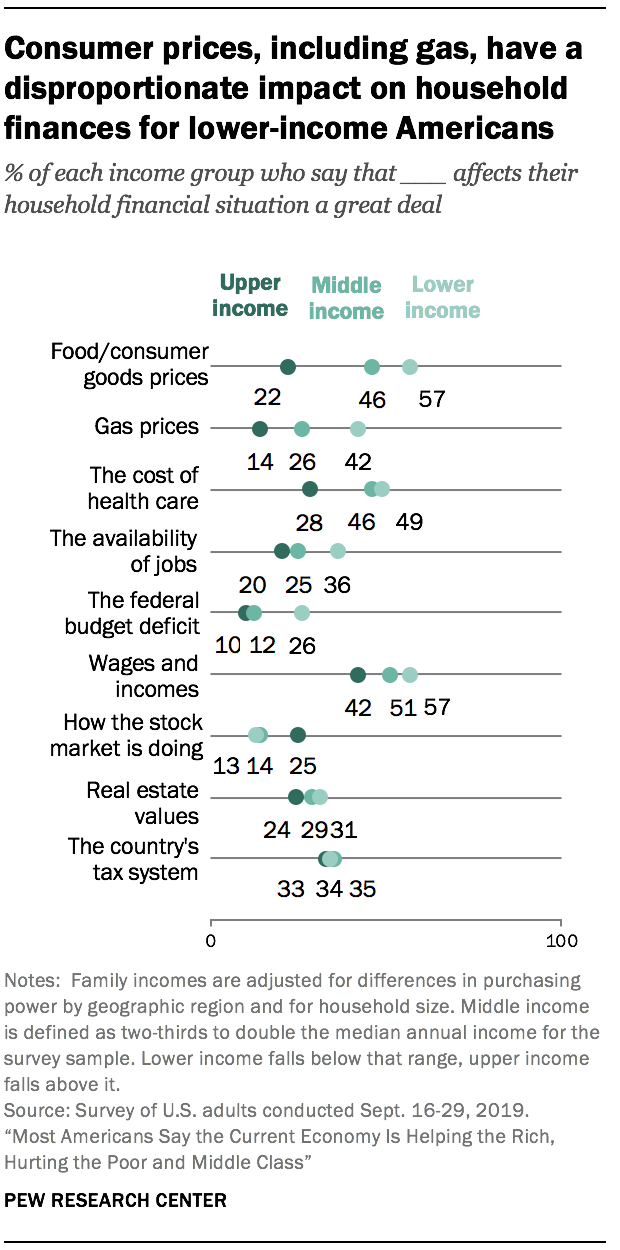

When it comes to the factors that influence their own household financial situation, Americans point to some – but not all – of the same indicators. Wages and incomes remain at the top, but less emphasis is placed on the overall availability of jobs. About half of the public (51%) says wages and incomes affect their household financial situation a great deal, 43% say the same about the cost of health care and 45% say prices for food and consumer goods impact them personally.

But other economic measures, such as the availability of jobs or the budget deficit, have a greater impact on the public’s perception of the economy than on their own household finances. While 45% say the availability of jobs contributes a great deal to their opinion about the economy, fewer (28%) say it has a great deal of impact on their own financial situation. Similarly, Americans are twice as likely to say the federal budget deficit impacts their views of the economy as they are to say it has a major impact on their household finances (32% vs. 16%).

The degree to which these various factors influence household finances differs significantly by income tier. Consumer prices and gas prices have a bigger impact on lower-income households than on middle- and higher-income households. Fully 57% of lower-income Americans say the price of food and consumer goods affects their household financial situation a great deal, compared with 46% of middle-income Americans and just 22% of those in upper-income households. Similarly, 42% of lower-income adults say the cost of gas has a significant impact on their financial situation, compared with 26% of middle-income adults and 14% of those in higher-income households.

The cost of health care affects lower- and middle-income households to a greater degree than is the case with higher-income households: About half or fewer of lower- (49%) and middle-income (46%) adults say health care costs affect their financial situation a great deal, compared with 28% of higher-income adults. On the other hand, upper-income adults are more likely to say the stock market impacts their household finances than are middle- and lower-income Americans (25% vs. 14% and 13%, respectively).

Majorities of adults say the current economy is hurting the middle class and the poor

Regardless of their views about the economy, a sizable majority of the public says the country’s current economic conditions are only helping certain groups of Americans. About seven-in-ten adults (69%) say that current economic conditions are helping people who are wealthy a lot (53%) or a little (16%). Just 10% of Americans say the current economy is hurting the wealthy and 19% say it is neither helping nor hurting.

In addition, the public sees more of an upside than a downside to current economic conditions for people with college degrees and people who are white. About half say these groups are being helped, while fewer say they are being hurt or neither helped nor hurt.

Higher-income Americans are the most likely to say that the current economy is helping wealthy people. About eight-in-ten upper-income Americans (81%) say this compared with 70% of middle-income and 62% of lower-income Americans.

Democrats are more likely than Republicans to say the current economy is helping the wealthy (77% vs 63%). Party differences persist among those in the upper-income tier (92% of Democrats vs. 70% of Republicans) and the middle-income tier (83% vs. 59%). However, among lower-income Americans, similar shares of Republicans (62%) and Democrats (63%) say the current economy is helping the wealthy.

Majorities of Americans say the economy is not working to the benefit of several other key demographic groups. Roughly two-thirds of Americans (64%) say that people who are poor are being hurt by current economic conditions (27% say they are being helped by the current economy). Similarly, 62% of adults say that people without college degrees are hurt by current economic conditions (23% say they’re being helped). Similar shares of Americans say that the current economy is hurting older adults (62%) and younger adults (61%). Meanwhile, roughly one-quarter of Americans say the economy is helping older (26%) and younger adults (28%).

About six-in-ten Americans (58%) say the economy is hurting those in the middle class, while 32% say the middle class is being helped by the current economy. Americans across income levels are about equally likely to say the current economy is hurting the middle class.

There are differences across parties, however, with Democrats much more likely than Republicans to say current economic conditions are hurting the middle class (72% vs. 41%) and the poor (83% vs. 41%). There are also differences within parties. Republicans are particularly divided by income when it comes to views of which groups the economy is hurting. For example, about half of lower-income Republicans (49%) say the economy is hurting the middle class, compared with smaller shares of middle-income (39%) and upper-income Republicans (33%). Majorities of Democrats across all income groups say the economy is not working for the middle class (77% of higher-income vs. 79% of middle-income vs. 61% of lower-income).

Lower-income Americans are about twice as likely as upper-income Americans to say the economy is hurting them and their family

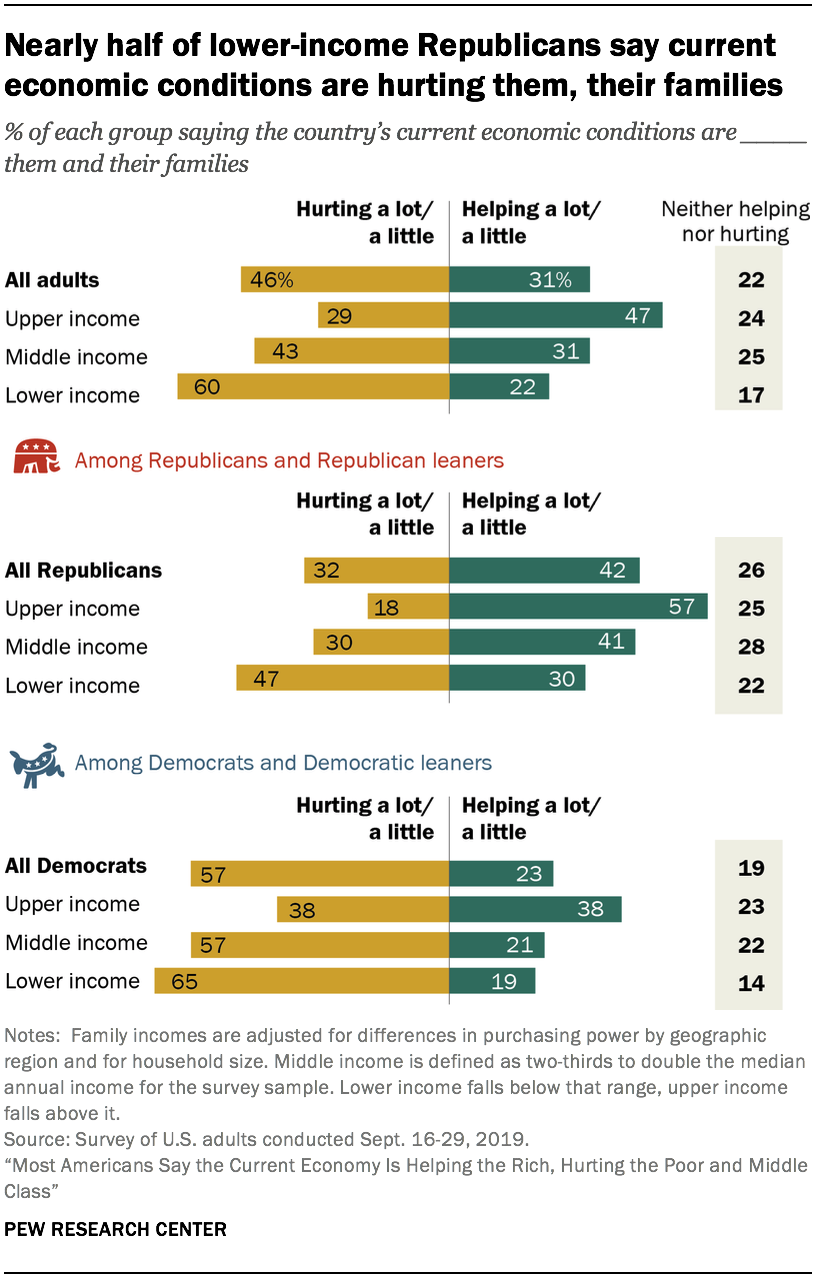

Only about three-in-ten adults (31%) say the economy is helping them and their family. Nearly half (46%) say current economic conditions are hurting them and their families, and 22% say they are neither helping nor hurting.

Lower-income Americans are especially likely to see current economic conditions as harmful: 60% say conditions are hurting them and their families, compared with 43% of middle-income and 29% of higher-income adults. About half of those in the higher-income tier say economic conditions are helping their families (47%), compared with only 22% of lower-income Americans.

There is also a partisan gap in the extent to which Americans see the economy working for themselves and their families. About four-in-ten Republicans (42%) say the economy is helping them, compared with roughly a quarter of Democrats (23%). Instead, a majority of Democrats (57%) say the economy is hurting them and their families (32% of Republicans say the same).

Differences by income tier persist within each party. Lower-income Republicans are far more likely than higher-income Republicans to say current economic conditions are hurting them (47% vs. 18%). Fully 57% of higher-income Republicans say the current economy is helping them, compared with 41% of middle-income Republicans and just 30% of lower-income Republicans.

There are also differences among Democrats. Roughly two-thirds of lower-income Democrats (65%) say that current economic conditions are hurting them, as do a majority of middle-income Democrats (57%). About two-in-ten middle-income (21%) and lower-income (19%) Democrats say the current economy is helping them. In contrast, upper-income Democrats are as likely to say the current economy is helping them as they are to say it’s hurting them (38% each).

About half of middle-income adults can meet basic expenses with a little left over

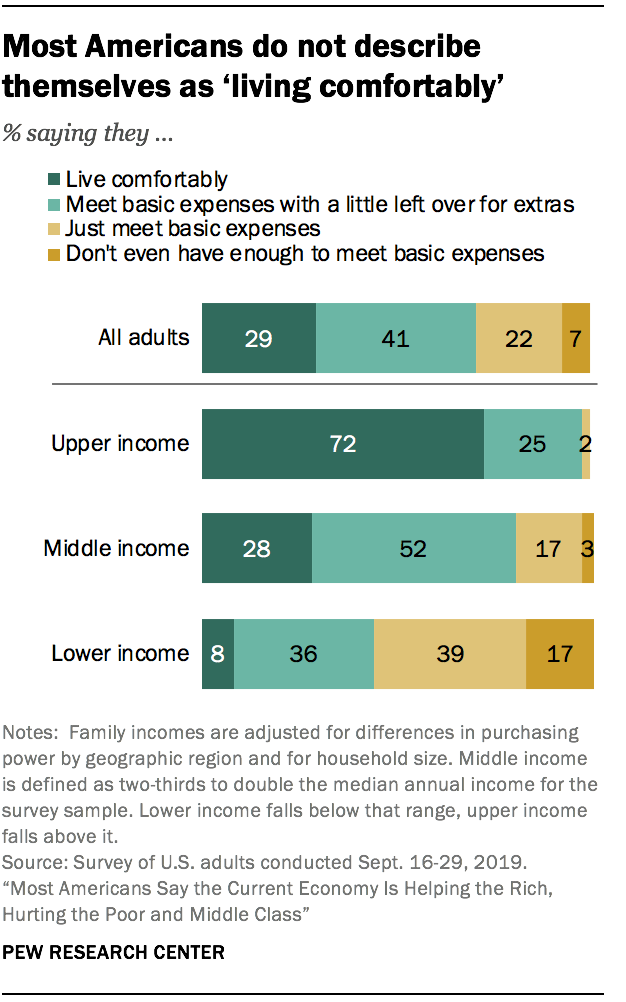

The current financial situation of Americans differs drastically by income group. Overall, about three-in-ten adults (29%) say they live comfortably, 41% say they meet basic expenses with a little left over for extras, 22% say they just meet basic expenses and 7% don’t even have enough to meet basic expenses.

Among upper-income Americans, 72% say they live comfortably. By comparison, 28% of middle-income and just 8% of lower-income Americans say the same. About half of middle-income Americans (52%) say they meet basic expenses with a little left over for extras, and 17% say they are just meeting basic expenses. Lower-income Americans, however, are about as likely to say they meet basic expenses with a little left over (36%) as they are to say they just meet basic expenses (39%). One-in-six lower-income Americans (17%) say they don’t even have enough to meet basic expenses.

White adults (35%) are more likely to say they live comfortably than are black (11%) or Hispanic (20%) adults. And Americans ages 65 and older are twice as likely to say they live comfortably as those ages 18 to 29 (45% vs 22%).

Lower-income Americans are more likely to say they lived comfortably while they were growing up than to say the same about their situation today (23% then vs. 8% now). Just the opposite is true for higher-income adults: About one-quarter (26%) say they lived comfortably while growing up, far fewer than the 72% who report living comfortably now.

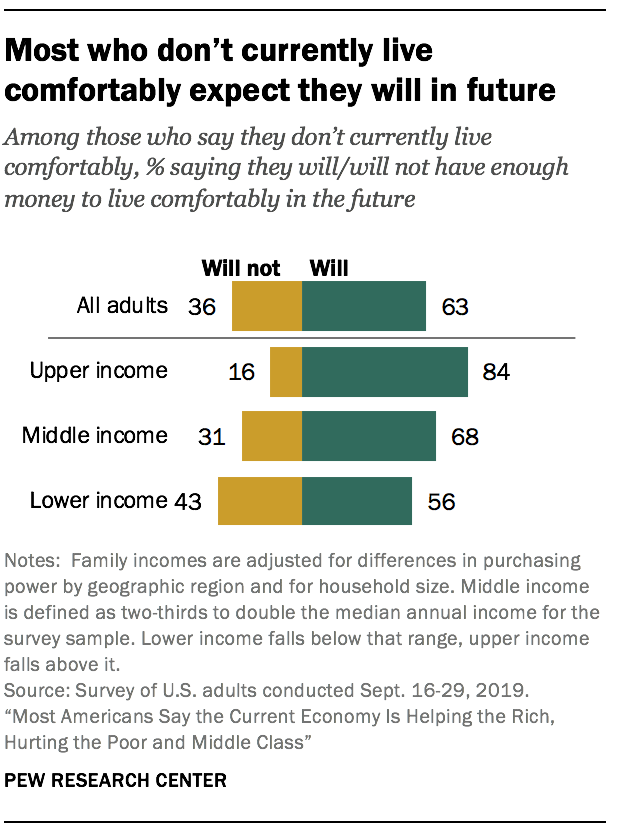

Though only about three-in-ten (29%) of all adults say they currently live comfortably, most of those who don’t are optimistic that they will in the future. Roughly six-in-ten adults who say they don’t currently live comfortably (63%) say they think they will have enough money to live comfortably in the future. There are significant differences by income, however. Among higher-income adults who say they don’t live comfortably now, 84% say that they think they will in the future. By comparison, 68% of middle-income and 56% of lower-income Americans who don’t live comfortably now say the same.

When asked to assess the financial situation of “most Americans,” the public paints a fairly negative picture. Only 5% of all adults say that most Americans live comfortably. About four-in-ten (38%) say most meet their basic expenses with a little left over for extras, and roughly half (47%) say most Americans just meet their basic expenses. An additional 9% say most Americans don’t even have enough to meet basic expenses.

Pluralities of all three income groups say they think most Americans are just meeting their basic expenses.

Roughly four-in-ten Americans say they frequently worry about the amount of debt they have

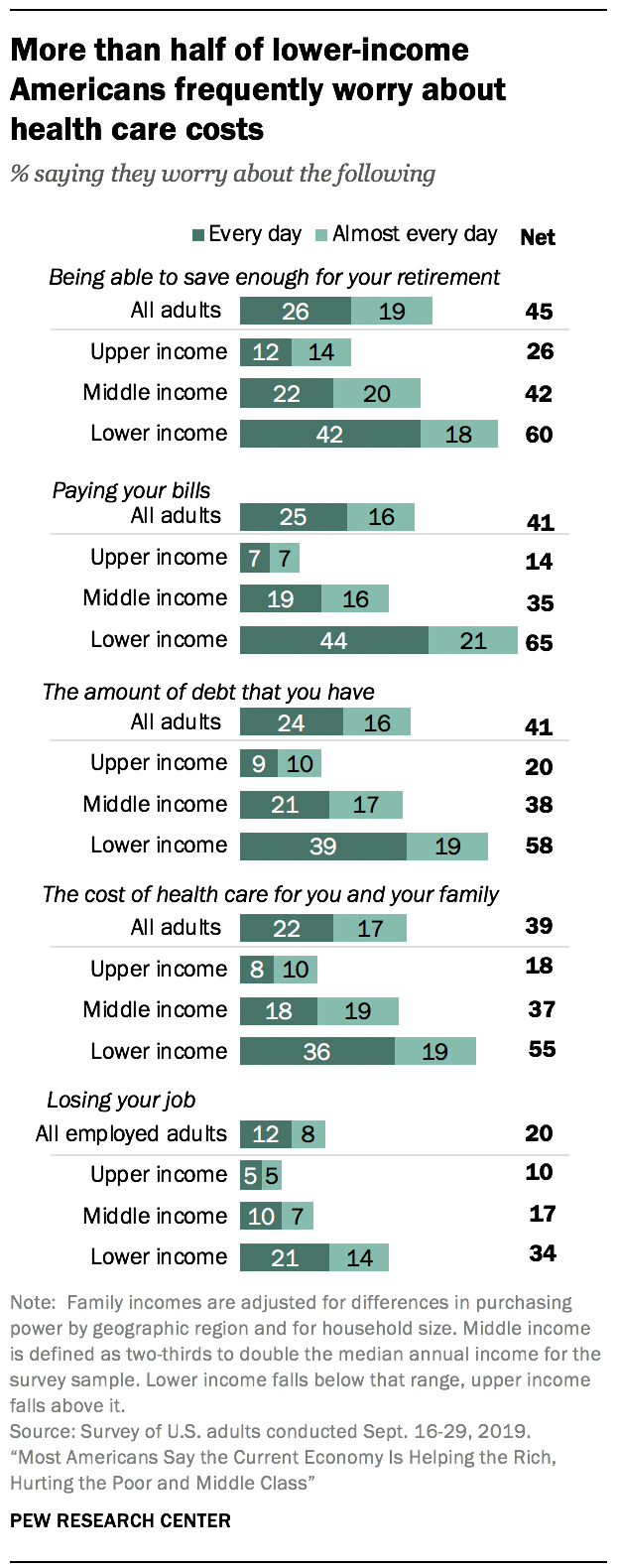

For many Americans, financial worries weigh heavily on their day-to-day lives. Some 45% say they worry every day or almost every day about being able to save enough for retirement. Sizable shares also worry almost every day or more frequently about paying their bills (41%), the amount of debt they have (41%) and the cost of health care for themselves and their family (39%). One-in-five employed Americans regularly worry about losing their job.

More than half of those with lower incomes say they frequently worry about paying their bills (65%), being able to save for retirement (60%), the amount of debt they have (58%) and the cost of health care for them and their families (55%). In contrast, about four-in-ten or fewer middle-class adults and smaller shares of those with higher incomes share these worries.

And while 34% of employed lower-income adults say they worry about losing their job every day or almost every day, 17% of workers with middle incomes and 10% of employed Americans with higher incomes say the same.

Few lower-income Americans have investments, about half have credit card debt

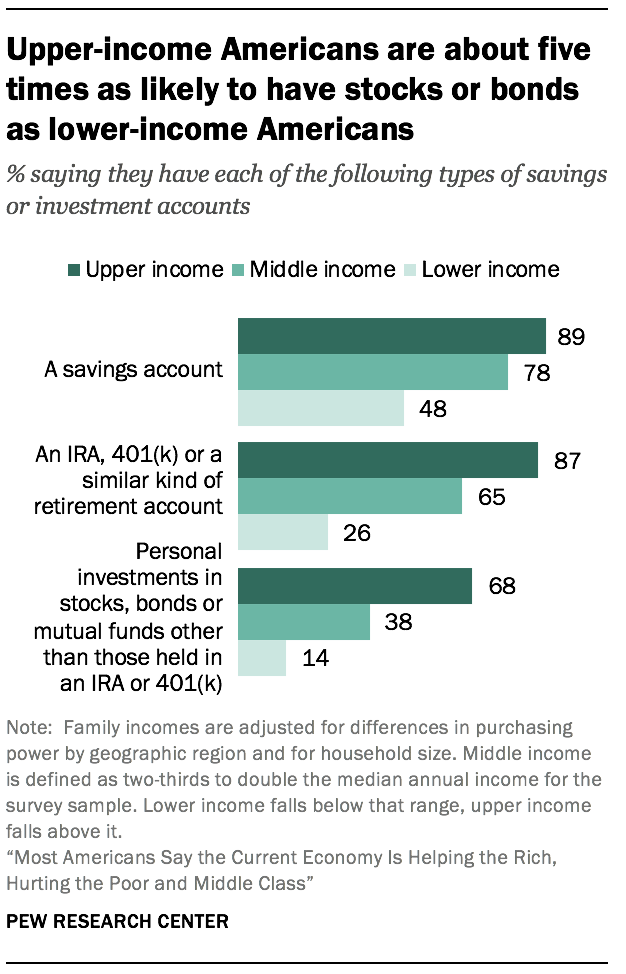

Experiences with savings and debt underscore the disparities that exist across income groups. Overall, about seven-in-ten Americans (69%) say they have some type of savings account, more than half (55%) say they have an IRA, 401(k) or a similar kind of retirement savings account, and about one-third (35%) say they have investments in stocks, bonds or mutual funds other than those held in an IRA or 401(k).

Upper-income Americans are especially likely to have each of these. About nine-in ten upper-income Americans have savings (89%) and retirement accounts (87%). Fewer (68%) have stocks or other personal investments.

Many middle-income Americans have a savings account (78%) and retirement account (65%), but fewer have stocks (38%). Just 14% of lower-income adults have stocks, and roughly one-quarter (26%) have retirement accounts. Still, a sizable share of lower-income Americans have savings accounts (48%).

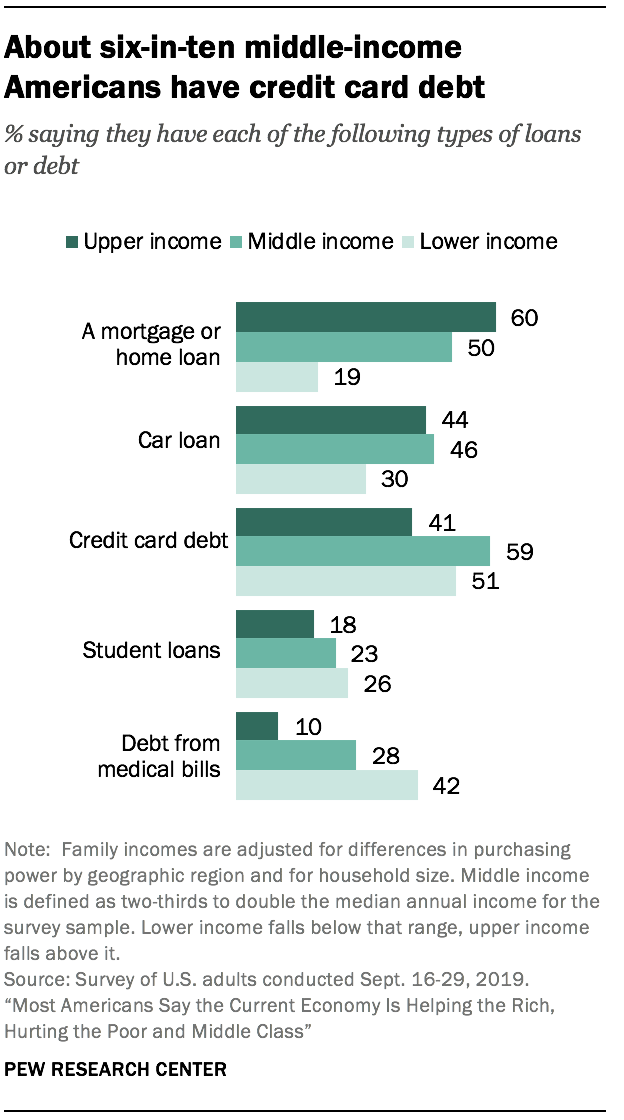

Roughly half of Americans (52%) report having credit card debt, about four-in-ten have a car loan and a similar share have a mortgage. About three-in-ten (29%) have debt from medical bills and roughly one-quarter (23%) have student loan debt.

Middle-income Americans are the most likely to have credit card debt – 59% do, compared with 51% of lower-income and 41% of upper-income adults. Lower-income Americans, however, are much more likely to have medical debt (42%) than those in the middle- (28%) or upper- (10%) income tiers.

Corrected on May 19, 2020: Certain data points in the following charts have been revised: “Public gives the economy mixed reviews;” “The availability of jobs matters more in assessments of the overall economy than in people’s own financial situations;” and “Majorities see current economic conditions helping the wealthy, hurting the poor and middle class.” Related changes have been made to any references in the text of the report. These changes do not substantively affect the report’s findings.